VWG Wealth Management 2022 3rd Quarter Review

By VWG Wealth Management on October 5, 2022

Executive Summary

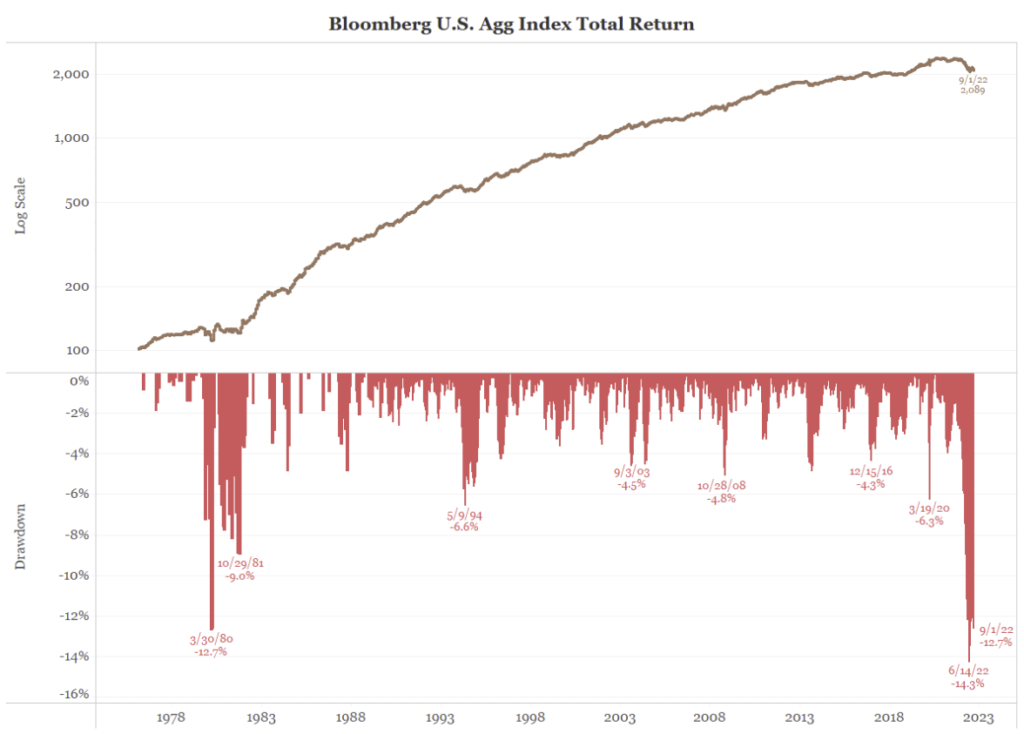

- Aggressive Federal Reserve actions and their voiced intentions to remain firm in combating persistent inflation set off central bank interest rate increases across the globe. The total return loss of the Bloomberg U.S. Aggregate Bond Index is now worse than in 1980. The Bloomberg Global Aggregate Bond Index is down 19.9% this year.

- The world is in the grip of a powerful U.S. dollar liquidity squeeze. This has the potential to lead to a global interest rate and tightening cycle that goes too far, damaging economies and potentially creating unintended consequences.

- Global currency declines (against the U.S. dollar) and sharp interest rate increases led to selling across most asset classes. The S&P 500 Index slid 4.9% in the quarter and has declined 23.9% this year. U.S. large stocks and U.S. bonds have now suffered negative returns for three quarters in a row. This has never occurred since the 1976 creation of the U.S. Aggregate Bond Index.

- Europe’s energy and food crisis, and signals that Russia was hardening their stance towards the Ukraine conflict, contributed to worse international stock performance. The MSCI EAFE developed market index lost 10.3% in the quarter and is down 27.2% this year.

- There are some signs that the majority of sharp interest rate and currency moves may be over. U.S. leading economic indicators are falling, the M2 measure of money supply has contracted, and supply chains and inventories are healing. If these trends continue it is possible that bond and stock markets can stabilize.

- Investor sentiment has declined to extreme levels. Long-term investors should be patient, continuing to hold balanced portfolio allocations despite expected periodic bouts of negative news and volatility.

- VWG urges investors to employ specific behaviors and actions to successfully navigate through the current economic and market stresses. Cash and ‘dry powder’ should be maintained. Tax-losses should be booked without altering exposure. Higher yields should be captured on cash and short-term bonds. It is critical to stay focused on durable long-term investment strategies and entrepreneurial operators. Attractive opportunities will be presented.

Review of the Markets

Asset prices continued their decline in the third quarter, as persistent levels of inflation led to global central bank rate increases and further measures of monetary tightening. The Federal Reserve led the way. It raised the federal funds overnight lending rate by 0.75% in July and again by 0.75% in September. Citing that the “labor market was out of balance” and that “forceful and rapid steps” were necessary to moderate demand, the Fed released median projections showing 4.4% as their target year-end rate. This is shocking considering that the same projection made last December was for 0.9%! They signaled their intention of continuing to hike further to 4.6% in 2023. It was implied that rate cuts would be unlikely until 2024. Global central banks reacted quickly, raising rates by larger-than-expected margins to combat the effects of a soaring dollar and rising inflation.

The first and second order effects of these massive rate moves, and cautionary projections, were widespread. The yield of the 10-year U.S. Treasury Note ended at 3.83%, rising by 0.86% in the quarter. The yield of the 2-year U.S. Treasury Note closed at 4.27%. This years’ 14.3% total return loss of the Bloomberg U.S. Aggregate Bond Index is now greater than in 1980.

Chart courtesy of Bloomberg / Bianco Research, LLC.

30-year mortgage rates touched 7.0%, their highest level since 2002. The Bloomberg Barclays High Yield Bond Index slipped 1.7% in the quarter and has declined 16.2% year-to-date. The S&P National Municipal Bond Index dropped 3.0% for the quarter and is down 10.6% this year. Foreign currencies continued their collapse, as the Euro, British Pound, and Japanese Yen all made multi-decade lows. The Reserve Bank of India, the Bank of Japan and the Bank of England all intervened to attempt to limit the debasement by buying their currencies. The Bloomberg Global Aggregate Bond Total Return Index is now down 19.9% this year.

Chart courtesy of Bloomberg / Bianco Research, LLC.

Stocks joined the broad asset contraction. The S&P 500 Index made a brave attempt to recover, rebounding 13.7% into mid-August before sliding below June’s lows. The benchmark index for U.S. large stocks fell 4.9% in the quarter and has now dropped 23.9% this year. The Russell 2000 Index, the benchmark for U.S. small stocks, retreating 2.1% in the quarter. It has fallen 25.1% this year.

International stocks were hit hard, as Europe’s spiking energy and food prices combined with declining currencies to push living costs higher and damage employment. The MSCI EAFE Index lost 10.3% in the quarter and is now down 27.2% for the year. Emerging markets stocks could fare no better, as zero-COVID policies in China and Hong Kong pressured economic activity. The MSCI Emerging Markets Index has fallen 29.1% this year, dropping 13.0% in the quarter.

On the back of aggressive central bank actions to fight inflation, almost all commodities fell as fears of global economic contraction spread. The NYMEX West Texas Intermediate Crude Oil continuous contract dropped 24.6% in the quarter. It is now only 6.0% positive for the year. Copper, often considered a barometer of the global economy, also declined. The NYMEX High Grade Copper continuous futures contract lost 8.6% and is down 24.0% this year. Natural gas spiked higher as the conflict in the Ukraine led to fears of inadequate Eurozone winter supplies. The NYMEX Henry Hub Natural Gas continuous futures contract rose 26.7%. It has increased 91.9% this year.

Inflation, Federal Reserve, and U.S. Dollar Roiling Global Asset Markets

The complex morass of global monetary, economic, pandemic, and geopolitical issues confronting our world, and the speed to which they are mutating, are staggering. Attempting to explain it, let alone understand it, is a Herculean effort. This quarter we turn the daunting task over to the brilliant economic historian Adam Tooze. Over the past ten years, his prodigious output of books, articles, newsletters, and blogs have greatly helped us try to understand the present and the past through a unique economic lens. The following is excerpted from two of his recent “Chartbook” newsletters, issues #151 and #152:

“Central banks around the world are under pressure. Surging prices stoke fears of persistent inflation. As ‘guardians of price stability,’ central bankers feel forced to react and interest rates are their preferred tool. Higher rates take the steam out of the economy. That should lower inflation. The price of pain is for borrowers and the risk of a recession and rising unemployment.

When taken together, the series of central bank policy moves add up to the most widespread global tightening of monetary policy since the start of the fiat money era in the 1970s.

Global Policy Rate Rises and Cuts

Chart courtesy of World Bank / AT Chartbook

This monetary policy tightening is compounded by a similar shift in fiscal policy. This attracts far less headline space than interest rates, but it too is unprecedented. The share of countries that are tightening their fiscal stance is greater today than it was during the global austerity drive after 2010, or in the heyday of the Washington consensus in the 1990s.

The panic around inflation should not lead us to underestimating this shift. The level of real interest rates (adjusted for inflation) remains low. But the risk is that this massive monetary and fiscal shift will be excessively contractionary and will trigger a worldwide recession. The U.S. has been in technical recession for two quarters. Under the impact of Putin’s war, Europe is teetering on the edge of a true contraction. China’s situation is more than fragile.”

Adding to the stress is the persistent strength of the U.S dollar and its role as the world’s reserve currency. At the end of August, the U.S. dollar index hit its highest level in 20 years. Once the Federal Reserve starts swiftly hiking, many other smaller countries have little option but to follow suit or face severe currency devaluation (which by raising import prices would stoke further inflation). “A lack of central bank coordination may lead to an interest-rate spiral that could lead to excessive tightening that could damage employment and global output.”

Chart courtesy of Strategas Research Partners

Even amongst the world’s largest economies, there are stark structural differences and divergent causes of regional inflation. There are widely varied potential risks of “fighting inflation with a bazooka.”

“The U.S. is facing a general inflation. It is modest in pace, but broadly based. Although not uniform, price increases extend to wages, rents, house prices, energy, and food. It makes sense for the Federal Reserve to respond to the U.S.’s broad-based price pressure. It is likely that they will be successful. The question is how sharp and sustained the rate hikes should be and what prices businesses and employees will pay for the resulting slowdown.

One thing the Fed is not worrying about, at least in the near-term, is financial stability. Equity and bond markets have struggled. With the end of quantitative easing, liquidity, U.S. treasury, corporate bond and stock markets have retreated markedly. But there is little reason to fear a systemic financial crisis.

The situation in Europe is quite different. Price increases are far less broad-based. Rather than a general inflation, it would be more properly described as an energy and food shock. The energy price shock is sufficiently serious to threaten a socio-political crisis as household and business budgets are wrenched out of balance. It is highly questionable whether central bank interest rate policy is a proper tool. The ECB’s difficulties are compounded by the fact that the European economy is far less robust that the U.S.’s. Making matters worse, any interest rate hike by the ECB risks unleashing the demons of Europe’s sovereign debt market.” Thus, European Central Bank policy has been put into an untenable position. If they fail to raise rates, they will be subject to further inflation, imported from a strong U.S. dollar. If they raise rates, they will threaten financial stability. Either way, energy and food shocks are not adequately being addressed.

There are some notable exceptions to the contractionary trend. The Bank of Japan is holding the line on yield curve control and is allowing the yen to depreciate against the U.S. dollar. Considering Japan’s decades long struggle with deflation, the BoJ is happy to accept the inflationary pressure that currency devaluation generates.

The People’s Bank of China is also bucking the trend. Early in September it actually cut rates. But that just goes to show the serious worries about China’s economy. It is facing a dramatic slowdown in growth. Youth unemployment is hovering dangerously close to 20 percent. Motivated by deep concerns about financial stability, China is deliberately acting to burst their property bubble which will require a delicate balancing act with potentially grave ramifications.”

Tooze concludes: “A global recession may well snap some of the weakest links in the dollar chain. If an uncoordinated surge in interest rates, driven by the Fed’s determination to control U.S. inflation leads to a global recession, it will raise real questions about the existing dollar system’s functionality. The risks of a build in inflationary momentum may be real. No less real, however, are the costs of the contractionary policy mix being applied now.”

Portfolio Strategy and Asset Positioning

Much is weighing on markets and investors. There are lots of reasons to be negative. Spiking inflation, fears of overtightening, and the unintended consequences of ‘things breaking.’ Street estimates for 2023 S&P 500 corporate earnings have been trimmed between 10% to 20%, to a level below 2022 earnings. They are being pressured by the slowing global economy and the sharp rise of the U.S. dollar (almost 40% of S&P 500 revenues are international). Russia’s mobilization and their purported sabotage of the Nord Stream Pipeline signals to some observers that this conflict will not soon be settled.

Volatility will almost certainly continue. Noted economist Mohamed El-Erian recently stated that, “we have to acknowledge that policy makers have changed from being suppressors of volatility to being contributors to volatility. We have to buckle our seat belts even tighter; it is going to be a bumpy road.”

Patience will be required. Perversely, part of this is due to the persistence of the strength of U.S. employment. Bank of America’s Stephen Juneau cautions: “the lags between monetary policy and changes in the labor market are much longer than the lags between policy and the housing market. Therefore, it could take time before we see material deterioration in labor demand, particularly given the momentum in the economy. That said, when it happens, it can happen quickly.”

Counterbalancing this are growing positives (from an inflationary stance). Some signs of economic slowing and the wringing of excesses are appearing. M2, a measure of U.S. money supply and liquidity, is rapidly declining. Although this is a significant factor in the decline in asset prices, it also points to longer-term cooling of inflation (as illustrated in the following chart). The price of lumber is now 65% off its high. Crude oil is 35% below its March peak. The ISM and NAHB leading economic indicators are declining, stated planned corporate capital expenditures are sliding, inventories are rising, and supply chains are easing.

Chart courtesy of Strategas Research Partners

The bulk of the painful moves in interest rates and the U.S. dollar are most likely behind us. If this is the case, the same could apply to stocks. El-Erian continues saying, “I do believe that we’re coming to the last phase of dollar strength and this surge in yields. The U.S. dollar’s three strong tailwinds – interest rate differentials, growth rate differentials, and safe-haven differentials – are all diminishing. The path will be difficult, but I believe we will move towards a better place, leaving behind a (global monetary) system that has caused incredible price distortions.”

Retail and institutional investor sentiment has become extremely negative. History has taught us many times that during such periods it is important to hold one’s ground, and not succumb to the crowd and the weight of negative arguments. The following Investor Intelligence ratio of bulls-to-bears show that when this measure is under 1.00 it has not been the most advantageous time for long-term investors to sell stocks. The respected National Association of Active Investors Managers (NAAIM) exposure index is showing a similar washout in sentiment.

Chart courtesy of Investors Intelligence / Yardeni Research, Inc.

VWG continues its balanced, measured stance. We are urging our clients to:

- Maintain focus on their long-term financial plans. When necessary, or due to a change in financial situation, update financial planning and projected future cash flows.

- Maintain adequate levels of portfolio cash and opportunistic ‘dry powder.’

- Take advantage of higher short-term rates to improve earnings on cash and short-term bonds.

- Harvest tax-losses by swapping into similar instruments so net exposure is not altered. These realized losses represent real value, and can be used to offset future realized gains, or to trim and reallocate positions in the portfolio.

- For clients that are underinvested or that have new funds to invest, set a plan to methodically add to investments. As volatility is likely, the size of positions being added should be modest and diversified.

- Seek opportunities in niche assets and securities offering high current and low-levered cash flows, and those differentiated and expected to be less economically cyclical. These include both public and private investments. VWG prefers those led and/or managed by highly entrepreneurial operators who possess vision, perspective, and integrity.

We extend our best wishes to families and friends who have homes and businesses in the path of Hurricane Ian. We hope that you are safe, and that you have not suffered great property damage.

Everyone please take care, and we’ll look forward to speaking with you soon!

Regards,

VWG Wealth Management

Suzanne, Ashley, Rashmi, Kay, Brandi, Lynette, Ona, Michelle, Ryan, Ryan, Ryan, Susan, Marnie, Justin, Elana, Patricia, John, Rick and Jeff

* Index Data and Charts Sourced from FactSet Research, Morningstar, Bloomberg, Strategas Research Partners, World Bank, Bianco Research LLC., Adam Tooze Chartbook, Investors Intelligence, Yardeni Research, Inc.

VWG Wealth Management is a team of investment professionals registered with HighTower Securities, LLC, member FINRA and SIPC, and with HighTower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through HighTower Securities, LLC; advisory services are offered through HighTower Advisors, LLC.

——————————————————————————————————————————————–

The information provided has been obtained from sources not associated with Hightower or its associates. All data and other information referenced herein are from sources believed to be reliable, although its accuracy or completeness cannot be guaranteed. Any opinions, news, research, analyses, prices, or other information contained in this report is provided as general market commentary, it does not constitute investment advice. VWG Wealth Management and Hightower shall not in any way be liable for claims, and make no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information, or for statements or errors contained in or omissions from the obtained data and information referenced herein. The data and information are provided as of the date referenced. Such data and information are subject to change without notice.

This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is not indicative of current or future performance and is not a guarantee. The investment opportunities referenced herein may not be suitable for all investors.

This document was created for informational purposes only; the opinions expressed are solely those of VWG Wealth Management, and do not represent those of Hightower Advisors, LLC, or any of its affiliates.

The 2019 Financial Times 300 Top Registered Investment Advisors is an independent listing produced by the Financial Times (June, 2019). The FT 300 is based on data gathered from RIA firms, regulatory disclosures, and the FT’s research. As identified by the FT, the listing reflected each practice’s performance in six primary areas, including assets under management, asset growth, compliance record, years in existence, credentials and accessibility. Neither the RIA firms nor their employees pay a fee to The Financial Times in exchange for inclusion in the FT 300.

Subscribe

VWG Wealth Management is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.

8201 Greensboro Drive

Suite 545

McLean, VA 22102

Office: (571) 406-4700

Toll Free: (888) 335-9020

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

©2025 Hightower Advisors. All Rights Reserved.