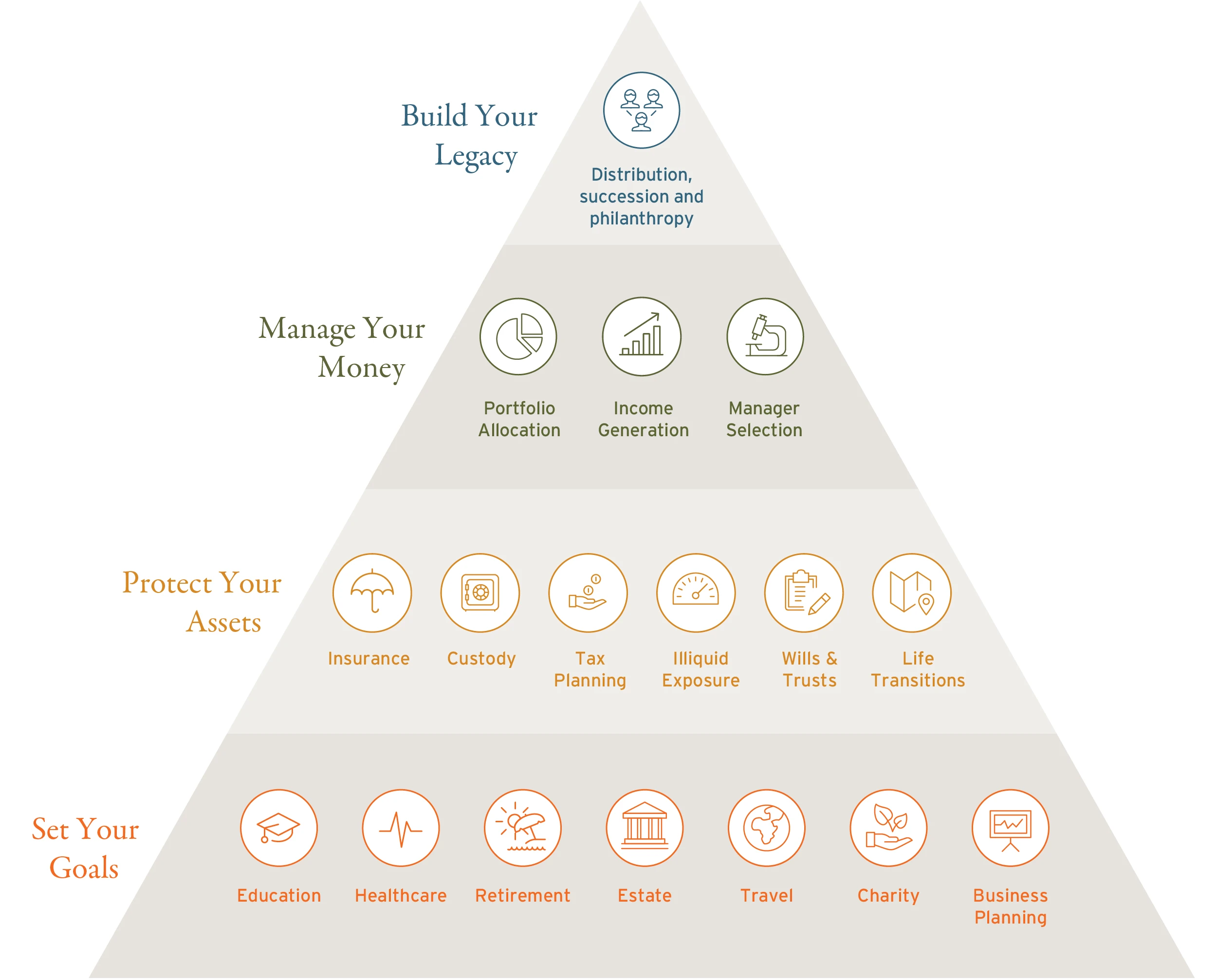

VWG values proactive goal setting and financial planning so our clients can live their lives to their fullest. Our client relationships start with setting your short term (1-3 years) and longer-term goals (3+ years), while thinking even further ahead to understand your vision for your legacy. These plans are the backbone for future financial decisions. Once we have created a comprehensive financial plan, we build and manage custom portfolios specific to your goals and risk tolerance. Beyond planning & investments, we offer a range of money management services and reporting tools to make managing your financial life as stress free as possible.

Financial Planning & Asset Protection Services:

Current income needs analysis & cash flow projections

Debt assessment & payoff strategies

Retirement projections / planning

Tax planning

Insurance needs analysis including long-term care, term/whole life & disability

Property & Casualty Insurance review, in-depth reviews of all policies, including excess liability

Estate planning in coordination with your estate planning attorney / titling of assets including retirement accounts and trusts

Education planning & funding

Family legacy planning including next-generation financial planning and asset management

Charitable giving strategies

Business succession planning

Plan coordination with your family’s other trusted advisors (CPAs, Trustees, Attorneys)

Investment Management Services:

Creation and supervision of custom portfolios

Risk management based on individual risk/return profile

Regular review of our goals-based investment objectives and custom allocation

Alternative Investments, including private equity, venture capital, private real estate, and structured notes

Ongoing due diligence and monitoring of managers and individual investments

Portfolio rebalancing and tactical overlay

Tax optimization and loss harvesting

Comprehensive online account access featuring portfolio performance monitoring and on demand reporting

Client Support Services:

Custody of assets with well-established, trusted firms

Comprehensive year-end tax reporting to designated CPA

Ongoing client education on changing market conditions, tax regulations, retirement rules and security policies

Access to secure Client Portal for consolidated view of accounts across financial institutions

Online vault for financial & other personal documents

Personalized service for day-to-day needs such as new account set up, wire transfers, bill payment and other money management services

8201 Greensboro Drive

Suite 545

McLean, VA 22102

Office: (571) 406-4700

Toll Free: (888) 335-9020

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

©2026 Hightower Advisors. All Rights Reserved.