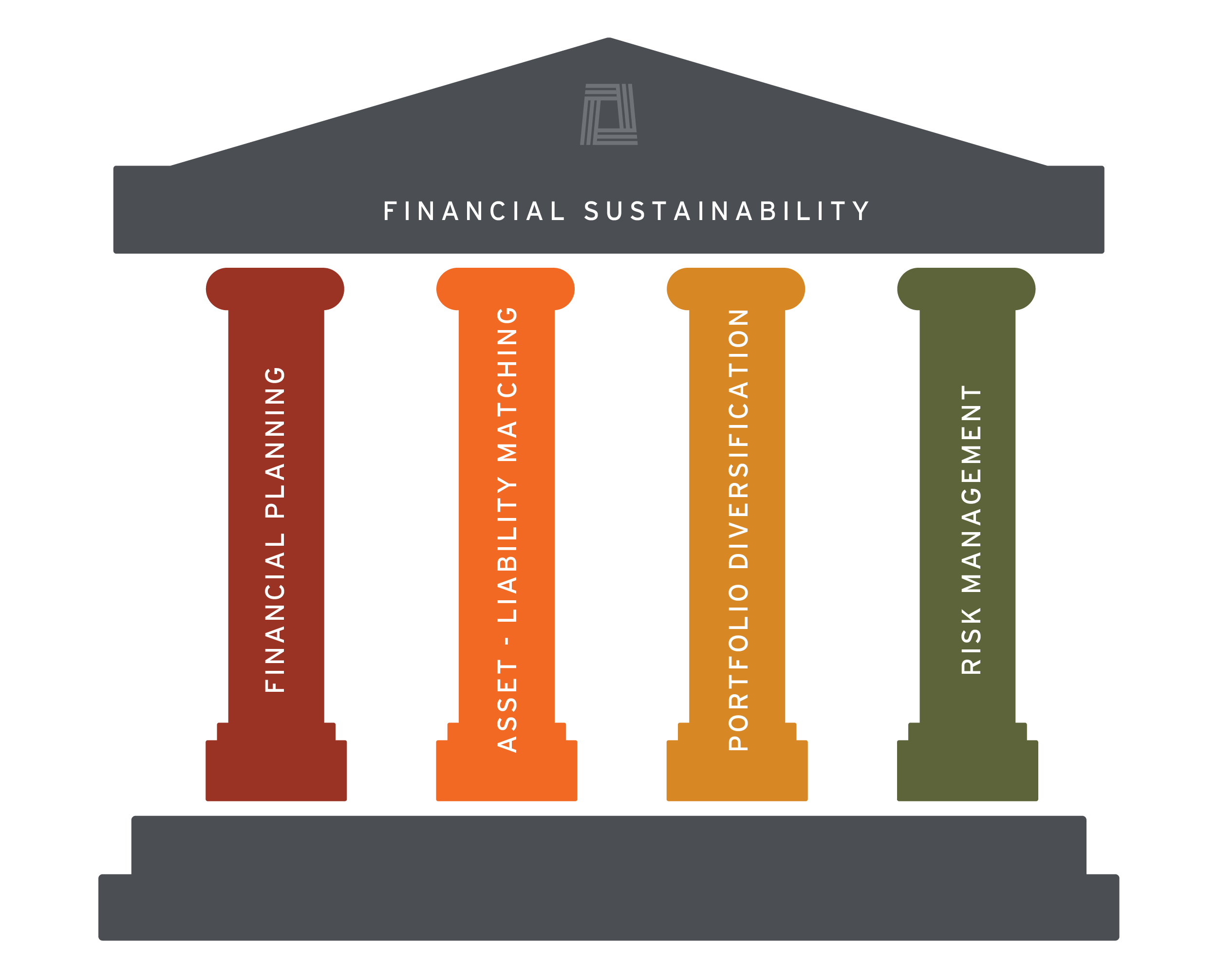

1. Financial Planning

Planning drives our entire investment process. To fully understand the specific needs of each client, we begin each relationship with a thorough financial plan. Often the hopes, fears and dreams we learn about our clients in developing the plan and what they uncover in themselves, becomes as invaluable as the plan itself. This plan then becomes the backbone for developing an appropriate portfolio, an acceptable risk / return profile and an overall blueprint for making future financial decisions.

2. Asset-Liability Match

Once we understand our clients’ needs and goals, we allocate the appropriate funds into one of four categories, each requiring a unique investment strategy and risk profile. These categories are: emergency (3-6 months of living expenses), medium-term (living needs and specific purposes for next 1-4 years), long-term (will be needed for living needs and specific purposes 5+ years from now), and legacy (not expected to ever be needed for living needs, ultimately for generational gifts and charitable intentions). We then match the duration of the investments to the duration of the need. For example, we would hold cash in an emergency fund and allocate stocks and private investments in a legacy fund.

3. Portfolio Diversification

VWG seeks to create and manage an investment portfolio tailored to each client’s specific needs, goals, tax sensitivity and temperament. We optimally group multiple asset types, strategies and liquidity profiles. Together, these will ideally provide a smoother return stream. Aiming to smooth overall portfolio returns serves to help keep our focus on the long-term and reduces the possibility of being dissuaded by short term noise and uncertainty. It is critical to maintain appropriate levels of cash and liquid high-quality bonds. These can be used for unexpected emergencies, and for future investment opportunities and tactical deployments.

4. Risk Management

Attention to risk is the foundation upon which we design all client portfolios. We believe that by avoiding certain risks, an investor can improve his or her long-term performance. It is our philosophy that diversification of capital is paramount in achieving positive long-term returns. Based on the plan’s required long-term return and our longer-term outlook for the capital markets, we develop a broad target allocation for each client’s portfolio. Within this allocation we design a combination of investments directed by disciplined managers and entrepreneurs, operating within a narrowly defined asset class or niche strategy. These managers and entrepreneurs should have the concept of a “margin of safety” deeply ingrained in their investment process.

8201 Greensboro Drive

Suite 545

McLean, VA 22102

Office: (571) 406-4700

Toll Free: (888) 335-9020

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

©2026 Hightower Advisors. All Rights Reserved.