VWG Wealth Management 2022 4th Quarter & Year-End Review

By VWG Wealth Management on January 9, 2023

Executive Summary

- Widely held expectations for subdued inflation and continuing low interest rates at the beginning of 2022 proved to be hugely erroneous. U.S consumer prices (CPI), a widely followed measure of inflation, exploded 8.6% year-over-year. The Federal Reserve responded with seven interest rate hikes totaling 4.25%. Broad declines occurred in most assets including bonds, stocks, and certain areas of real estate and commodities. There were very few places of shelter for long-term investors.

- The Bloomberg U.S. Aggregate Bond index dropped 13.0% for the year. US large stocks as measured by the S&P 500 index fell 19.4%, its worst loss since 2008. A portfolio of 60% stocks and 40% bonds, commonly held in employer-sponsored retirement plans, suffered its worst loss in the past 100 years.

- Most of the issues that weighed on global markets last year persist as we move into 2023. All eyes are on the Federal Reserve as it attempts to arrest high inflation without severely damaging the economy, employment, and corporate earnings.

- VWG does not believe investors should expect inflation to recede quickly or smoothly.

- The extremely accommodative monetary policies embraced by global central banks over the past 12 years, including zero-interest rate policies and quantitative easing, may have reached their limits. A swift return to these should not be expected.

- Bear markets often mark regime changes. VWG is vigilant, and we caution investors from quickly returning to strategies that worked best over the past period. We do not believe that a ‘Fed pause’ will be an ‘all-clear’ signal to aggressively shift portfolio positioning.

- Long-term investors should be patient and should continue to hold balanced portfolio allocations. Periodic volatility and negative headline news should be expected.

- VWG is optimistic that attractive opportunities will emerge. Paradoxically, lower prices and higher current yields in quality assets offer better risk-adjusted long-term returns. Less central bank interference could lead to a more accurate cost of capital, creating more rational markets. Adequately funded entrepreneurs and emerging, disruptive technologies have great potential to create and increase market share when stressed competitors struggle.

Review of the Markets – The World Has Changed

It is a gross understatement that financial markets proved extremely difficult in 2022. Most of the pain emanated from hugely erroneous and widely held assumptions on the severity of inflation and the expected course of interest rates. These were so far off from what evolved that revisiting them in our minds seems surreal. The world has changed. Deutsche Bank states:

“With markets increasingly confident of a terminal rate around 5.00% and inflation getting back close to target in 2024, it’s worth remembering that exactly a year ago today markets were pricing a Fed funds rate of 0.68% by the end of 2022 and economists were calling for CPI of 2.6%.”

From this starting point, almost all asset classes suffered sharp losses. The U.S. consumer price index continued to rise, hitting a year-over-year high of 9.1% in June. The Minneapolis’ Fed estimate of the full year 2022 CPI of 8.6%, would be its highest since 1981 and the 6th highest measure since 1947. In response to the level and persistence of inflation, the Federal Reserve made 7 rate hikes totaling an increase of 4.25%. Quantitative tightening measures were enacted to reverse massive liquidity that had been created in response to the COVID-19 pandemic.

The Bloomberg U.S. Bond Aggregate lost 13.0%, the worst year in its 46-year history. The yield on the 10-year U.S. Treasury note finished at 3.88% after hitting a 15 year high of 4.32% in October. It started the year yielding 1.51%. The Bloomberg Barclays High Yield Bond Index dropped 12.2%. The S&P Municipal bond Index was down 7.4%. The average U.S. 30-year mortgage rose above 7% for the first time in over 20 years.

The S&P 500 index dropped 19.4% for the year. It suffered three consecutive quarterly declines before bouncing back 7.5% in the 4th quarter. The tech-heavy Nasdaq Composite index lost 33.1%. U.S. small stocks as measured by the Russell 2000 index fell 21.6%.

In tandem, U.S. stocks and bonds had one of their worst years in history. 2022 was only the 5th time since 1928 that U.S. stocks and bonds both dropped in value. Within these 5 occurrences, 2022’s loss in the bond market was more than twice as bad as the others.

Despite deep overhanging concerns over the Russia/Ukraine war, inflation spiking to double-digits, and the Eurozone’s struggle to secure vital oil and natural gas supplies, international stocks in developed markets outperformed U.S. stocks. The MSCI EAFE index lost 16.8% for the year, buoyed by its strong 17.0% rebound in the 4th quarter. The MSCI Emerging Markets index slumped 20.6% for the year. It recovered 10.3% in 4th quarter despite serious concerns over the strength of China’s economy and its widespread COVID lockdowns.

Despite 2022’s intent focus on oil prices and supplies, marked by it spiking to $120/barrel at the onset of the Ukraine crisis, crude finished only slightly higher. The NYMEX West Texas Intermediate Crude Oil continuous futures contract was up 7.0%. Any moderation of global inflation in 2023 will be widely dependent on energy pricing. The NYMEX Gold continuous futures contract was flat for the year, despite rebounding 11.9% in the fourth quarter.

Concerns Weighing on Markets Entering 2023

Almost all the issues that weighed on markets last year persist as we move into 2023. The struggle to control inflation, and how significantly the Federal Reserve’s tightening measures slow or damage the U.S. economy, remains at center stage. The course of this battle will have great impact on employment, corporate earnings, interest rates, currencies, and asset prices in 2023. Torsten Slok, Chief Economist of Apollo Global Management, states: “The question for markets is not whether inflation is falling, everyone agrees that inflation is falling. The question is how fast. Some say very quickly, and others including some Fed working papers say 3 years. How much demand destruction is needed to get to the stated target 2% inflation?”

Inflation and the U.S. economy are joined by numerous serious issues troubling markets, including:

- The weakening global economy, with many countries still suffering devastating double-digit levels of inflation.

- The outcome of China’s efforts to re-start their economy by lifting their ‘zero-COVID’ policy.

- The risk that 2023 US corporate earnings will be pressured by higher costs and falling demand, which may not be fully priced into markets.

- The continuing Russia / Ukraine war, its ramifications on vital food, energy, and raw material supplies, and its costs on supporting allies.

- U.S. / China trade tensions and the ramping of restricted access to technology.

- The possible transition to a multipolar world, the potential onshoring of critical manufacturing and supplies, and the greater focus on food and energy security, all of which could be inflationary.

It is almost impossible for us to comment on all of these, or to surmise how they may affect investors. However, here are some of our key observations and commentary from respected strategists and economists:

Inflation should not be expected to recede smoothly.

We should take Jerome Powell at his word, and not attempt to ‘game’ Federal Reserve moves.

It is quite possible that markets are expecting that inflation will decline smoothly and steadily. Imbedded into this is the hope that the Federal Reserve will negotiate a “soft landing,” which will soon stabilize interest rates, asset prices and corporate earnings. This is unchartered macro territory, and we are not economists, but VWG does not believe this should be investor’s base case assumption.

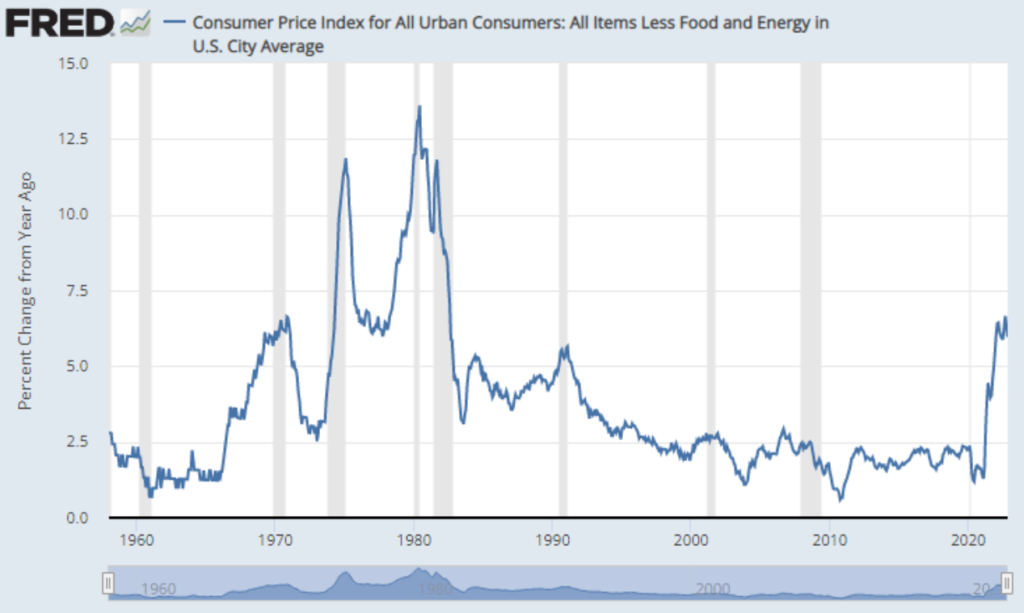

Bob Elliott, former head of research at Bridgewater Associates, recently commented “what many are missing is how hard it is to bring inflation down once it gets going.” Look at the 1970’s and 80’s (following chart). There were several tightenings and easings before inflation was sustainably controlled. And there was a whole lot of uncertainty through the process. Why would you expect this to be such an easy ride today? Markets are priced for near perfection in inflation and the odds that happens are low.”

Chart courtesy of U.S. Bureau of Labor Statistics

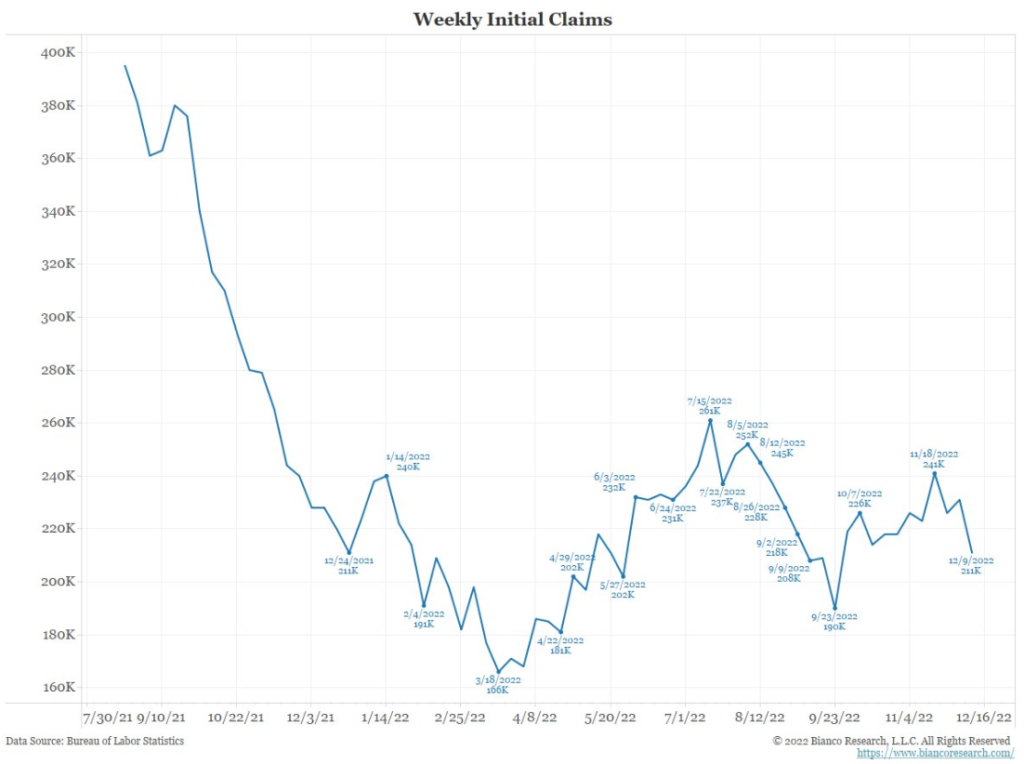

Although many areas of economic activity have turned negative or are clearly headed in that direction, employment is persistently strong. Economist Jim Bianco states “the jobs market is not weakening (see following chart of weekly initial jobless claims). The Fed has signaled that it will not change stance until the labor market shows unmistakable signs of weakening. There are still 1.7 open jobs for every unemployed person. Payrolls have beaten estimates in 11 of the past 12 months. There is typically a 12-month lag between rising unemployment and decreases in wages.” With demographics and immigration restraints significantly impacting the (lack of) labor slack, it is unclear whether monetary policy alone can soften employment without severely damaging the economy.

Chart courtesy of Bianco Research LLC / U.S. Bureau of Labor Statistics

Bottom line: We should expect higher interest rates for longer, until economic conditions sustainably soften. We should take Jerome Powell at his word, in that regardless of where the Fed’s increases end, interest rates will not be cut in the foreseeable future:

“It is likely that restoring price stability will require holding policy at a restrictive level for some time. History cautions strongly against prematurely loosening policy. We will stay the course until the job is done.”

Relentless Central Bank Accommodation Will Not Soon Return

We should not expect a quick return to massive zero-interest rate policies (ZIRP), quantitative easing (QE) and other easy monetary policies enjoyed over the past 12 years. The genie is out of the bottle. It is quite apparent that the limits of these policies have been reached. Even Japan’s more closed monetary system and demographically challenged economy has begun displaying this. Strategas Research Partners’ CEO Jason Trennert comments:

“The ‘unconventional monetary policy’ that came to be called quantitative easing is no longer tenable in the face of persistently high inflation. The bill has come due. Even for the US as the world’s reserve currency – no longer will spending one’s way out of economic and financial difficulties be without cost.”

As such, investors should rethink investment strategies that have overly relied on abundant liquidity and cheap leverage. In his recent memo “Sea Change,” Howard Marks, legendary investor and co-founder of Oaktree Capital observes:

“Although most of us believe the free market is the best allocator of economic resources, we haven’t had a free market in money (cost of capital) for well over a decade. (Going forward) the Fed might prefer to reduce its role in capital allocation by being less active in controlling rates and buying bonds.” (link)

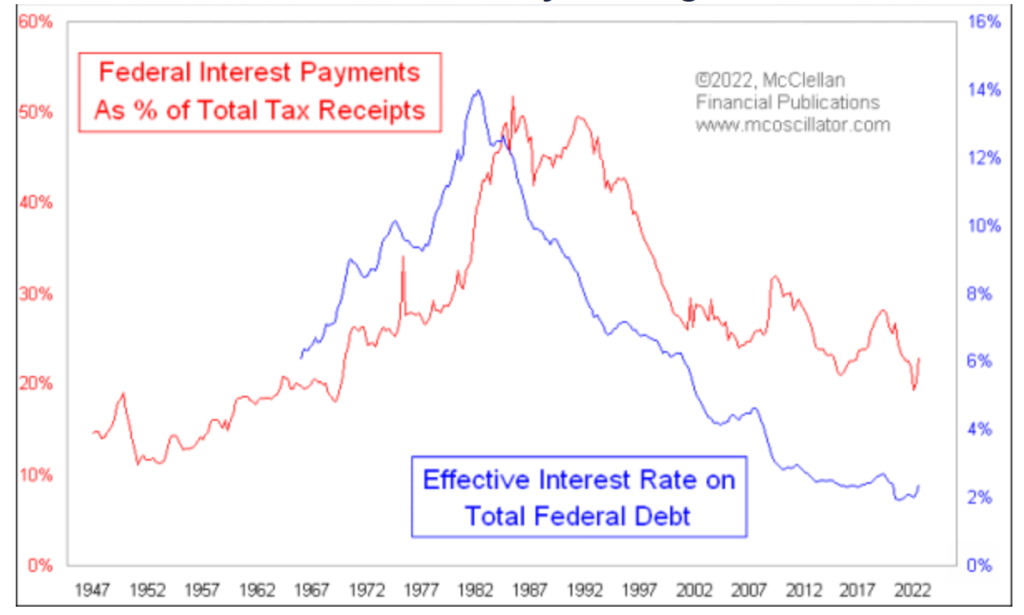

Aside from the pain inflation unproportionally inflicts on lower income households, and the self-reinforcing behavior inflation creates, there is another potential stress that cannot be ignored. This is the cost of interest payments on the federal debt. Massive debt has been accumulated by central banks over the past 40 years. As shown in the following chart, interest payments on the federal debt as a percentage of total tax receipts topped at over 50% in the 1980’s when the total U.S. federal debt was only 31% of GDP (and the interest rate on the debt was much higher). Federal debt now stands at 120% of GDP. Simply doubling the interest rate paid on refinancing this debt will place huge stress on our government’s finances and balance sheet. Inflation and interest rates must somehow be controlled.

Chart and data courtesy of McClellan Financial Publications

A Regime Change is Probable

Not always apparent during their midst, bear markets often mark economic and investment regime changes. One example is the 1973-75 recession that marked the end of the ‘Nifty-50’ stock era, and the start of a 15-year struggle to contain inflation. Another is the 2001 recession and the bursting of the ‘Dot.com Bubble.’ One cannot fully predict the future. However, if the end of ‘free money,’ QE and ZIRP central bank policies are over for now, we should expect that the “investment strategies that worked best may not be the ones that outperform in the years ahead.” Howard Marks instructs us:

“The (positive) effect of declining rates over the past 40 years are nearly impossible to overstate. It increased investor risk taking. Paltry yields on safe investments drove investors to buy riskier assets. FOMO – the fear of missing out – became the prevalent behavior among investors. Buyers were eager to buy, (and buy more on every dip), and holders weren’t motivated to sell.”

VWG does not believe that the first Fed pause, or even the first Fed rate cut, will be the ‘all clear’ signal to pile back into more risky strategies. Counterintuitively, many strategists are concerned that a Fed pausing too quickly, or a market that front-runs the Fed too far in advance, threatens long-term stability. Jim Bianco states that “this would raise a real risk of higher inflation for longer.” Patience is going to be required.

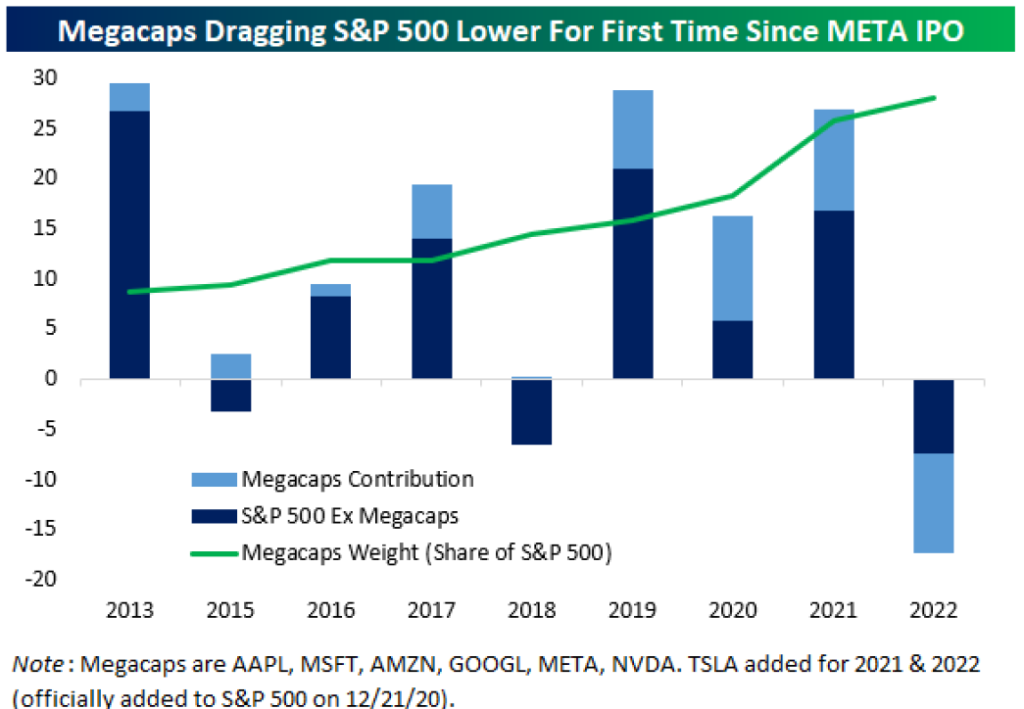

The U.S. stock market is already displaying signs of a possible regime change. 2022 was the first year since 2013 that mega-cap stocks detracted from the performance of the S&P 500. During this period the total weighting of the five largest stocks in the index rose from 8.5% to a staggering 22% in September 2020 (per Bespoke Investment Group). With more than half of 2022’s S&P 500 losses coming from the mega-caps, this weighting has dropped to 17%.

Chart courtesy of Bespoke Investment Group

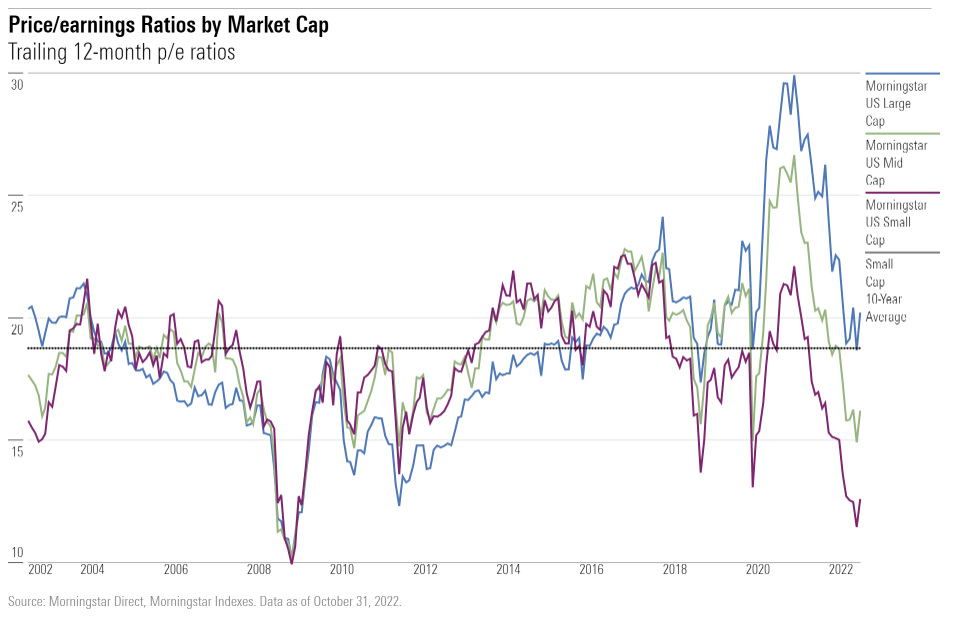

One hint of possible regime change is 2022’s outperformance of stocks in international developed markets versus the S&P 500. This despite the Eurozone’s intensely negative economic narrative in the shadow of the war in the Ukraine. Another is the relative low valuation of U.S. small stocks versus large stocks which peaked in 2021 and has not meaningfully narrowed. 2022 saw small stocks reach their cheapest valuations since 2008 on a price-to-earnings (P/E) basis. We must be reminded that stocks do not appreciate based on valuations alone. Past performance, and periods of recent underperformance, are no guarantees of future results.

Portfolio Positioning and Potential Positives

Higher interest rates, the retraction of massive stimulus and liquidity, and potential regime changes – will eventually bring opportunities. It is very possible that 2023 continues as a slow slog. It is also possible the Fed overtightens monetary conditions, plunging the U.S. economy into painful recession. The myriad of concerns weighing on the global economy and markets could very well take a few years to clear. Jason Trennert cautions:

“In this environment, investors should expect greater economic and financial market volatility, slower economic growth, a rationing of investment capital, and more modest returns from financial assets.” However, the opportunity set for assets and strategies offering better risk-adjusted returns are growing. Pessimism abounds, and asset prices reflect this uncertainty. The end of the chase for yield in an artificial zero-interest environment could lead to less crowding into overvalued assets. The investment landscape could become more rational and healthier, offering patient long-term investors opportunities to buy assets at more attractive prices. There are already broader alternatives of assets generating true cash flows and yields, that offer the potential for ‘equity-like’ returns.

VWG continues to stress moderate and highly diversified portfolio positioning:

- We are long-term investors. Some assets are looking increasingly attractive. Eroding economic conditions and corporate earnings could lead to volatility which could broaden long-term opportunities. Visionary, well-funded businesses and innovators can build market share organically and through acquisitions during periods of economic duress.

- VWG has never ‘chased’ huge asset gathering strategies on behalf of our clients.

- Our core investment strategy is allocating to disciplined managers who can seek out idiosyncratic opportunities in more narrow verticals that may be more insulated from macro events. These managers may be able to outperform if modest returns result from the economic challenges we outline. The end of a ‘rising tide lifting all ships’ era, should it emerge, could help support prices of less widely owned assets.

- More strategies offering solid current yields and potential cash flows are emerging. Higher rates give more options in structuring fixed income portfolios, based on clients’ projected needs.

- Adequate levels of cash and liquidity should be maintained to weather possible market and economic volatility, and to fund future opportunities.

- As always, planning should drive individual custom allocation decisions that are dedicated to both cash/living needs/emergency needs, and to long-term appreciation/aspirational/legacy goals.

- We will be vigilant and patient, but opportunistic.

As difficult as 2022 has been, VWG is comforted by our belief that a lot of the pain is behind us, and that attractive opportunities will emerge. Our faith – in entrepreneurship, the creator economy, American business, the American rule of law, and on disruptive emerging technologies that will improve quality of our lives – remains absolute. We are deeply touched by the dialogue and compassion so many of our clients have expressed this year as we have attempted to navigate a most complex situation.

Please accept our wishes for good health for you and your family in 2023. We hope everyone gets to spend lots of time with family and friends, sharing good times, activities, laughter, and passions. We look forward to speaking with you in the New Year!

Regards,

VWG Wealth Management

Suzanne, Ashley, Rashmi, Kay, Brandi, Lynette, Ona, Michelle, Ryan, Ryan, Ryan, Susan, Marnie, Justin, Elana, Patricia, John, Rick and Jeff

* All stated index returns are as of 12/30/2022 unless otherwise indicated.

* Index Data and Charts Sourced from FactSet Research, Morningstar, Bloomberg, Strategas Research Partners, Bianco Research LLC., McClellan Financial Publications, U.S. Bureau of Labor Statistics.

| VWG Wealth Management is a team of investment professionals registered with HighTower Securities, LLC, member FINRA and SIPC, and with HighTower Advisors, LLC, a registered investment advisor with the SEC. Securities are offered through HighTower Securities, LLC; advisory services are offered through HighTower Advisors, LLC. The information provided has been obtained from sources not associated with Hightower or its associates. All data and other information referenced herein are from sources believed to be reliable, although its accuracy or completeness cannot be guaranteed. Any opinions, news, research, analyses, prices, or other information contained in this report is provided as general market commentary, it does not constitute investment advice. VWG Wealth Management and Hightower shall not in any way be liable for claims and make no expressed or implied representations or warranties as to the accuracy or completeness of the data and other information, or for statements or errors contained in or omissions from the obtained data and information referenced herein. The data and information are provided as of the date referenced. Such data and information are subject to change without notice.This is not an offer to buy or sell securities. No investment process is free of risk, and there is no guarantee that the investment process or the investment opportunities referenced herein will be profitable. Past performance is not indicative of current or future performance and is not a guarantee. The investment opportunities referenced herein may not be suitable for all investors. This document was created for informational purposes only; the opinions expressed are solely those of VWG Wealth Management, and do not represent those of Hightower Advisors, LLC, or any of its affiliates. Disclosures VWG Wealth Management is a team of investment professionals registered with Hightower Securities, LLC, member FINRA and SIPC & Hightower Advisors, LLC a registered investment advisor with the SEC. All securities are offered through Hightower Securities, LLC and advisory services are offered through Hightower Advisors, LLC. This is not an offer to buy or sell securities. No investment process is free of risk and there is no guarantee that the investment process described herein will be profitable. Investors may lose all of their investments. Past performance is not indicative of current or future performance and is not a guarantee. In preparing these materials, we have relied upon and assumed without independent verification, the accuracy and completeness of all information available from public and internal sources. Hightower shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This document was created for informational purposes only; the opinions expressed are solely those of the author, and do not represent those of Hightower Advisors, LLC or any of its affiliates. Third-party links and references are provided solely to share social, cultural and educational information. Any reference in this post to any person, or organization, or activities, products, or services related to such person or organization, or any linkages from this post to the web site of another party, do not constitute or imply the endorsement, recommendation, or favoring of VWG Wealth Management or Hightower Advisors, LLC, or any of its affiliates, employees or contractors acting on its behalf. Hightower Advisors, LLC, does not guarantee the accuracy or safety of any linked site. Hightower Advisors do not provide tax or legal advice. This material was not intended or written to be used or presented to any entity as tax advice or tax information. Tax laws vary based on the client’s individual circumstances and can change at any time without notice. Clients are urged to consult their tax or legal advisor for related questions. |

Subscribe

VWG Wealth Management is a group comprised of investment professionals registered with Hightower Advisors, LLC, an SEC registered investment adviser. Some investment professionals may also be registered with Hightower Securities, LLC (member FINRA and SIPC). Advisory services are offered through Hightower Advisors, LLC. Securities are offered through Hightower Securities, LLC.

This is not an offer to buy or sell securities, nor should anything contained herein be construed as a recommendation or advice of any kind. Consult with an appropriately credentialed professional before making any financial, investment, tax or legal decision. No investment process is free of risk, and there is no guarantee that any investment process or investment opportunities will be profitable or suitable for all investors. Past performance is neither indicative nor a guarantee of future results. You cannot invest directly in an index.

These materials were created for informational purposes only; the opinions and positions stated are those of the author(s) and are not necessarily the official opinion or position of Hightower Advisors, LLC or its affiliates (“Hightower”). Any examples used are for illustrative purposes only and based on generic assumptions. All data or other information referenced is from sources believed to be reliable but not independently verified. Information provided is as of the date referenced and is subject to change without notice. Hightower assumes no liability for any action made or taken in reliance on or relating in any way to this information. Hightower makes no representations or warranties, express or implied, as to the accuracy or completeness of the information, for statements or errors or omissions, or results obtained from the use of this information. References to any person, organization, or the inclusion of external hyperlinks does not constitute endorsement (or guarantee of accuracy or safety) by Hightower of any such person, organization or linked website or the information, products or services contained therein.

Click here for definitions of and disclosures specific to commonly used terms.

1919 Gallows Road

Suite 330

Vienna, VA 22182

Office: (571) 406-4700

Toll Free: (888) 335-9020

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

©2025 Hightower Advisors. All Rights Reserved.